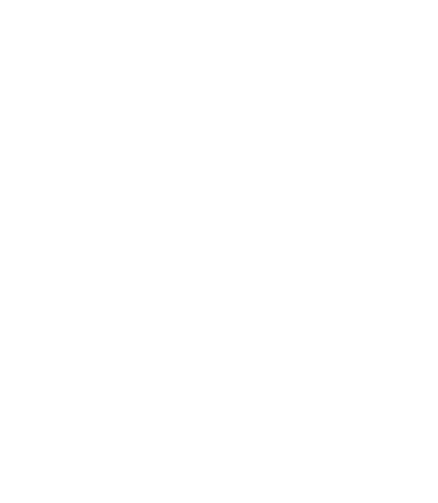

MISSION

Our practice

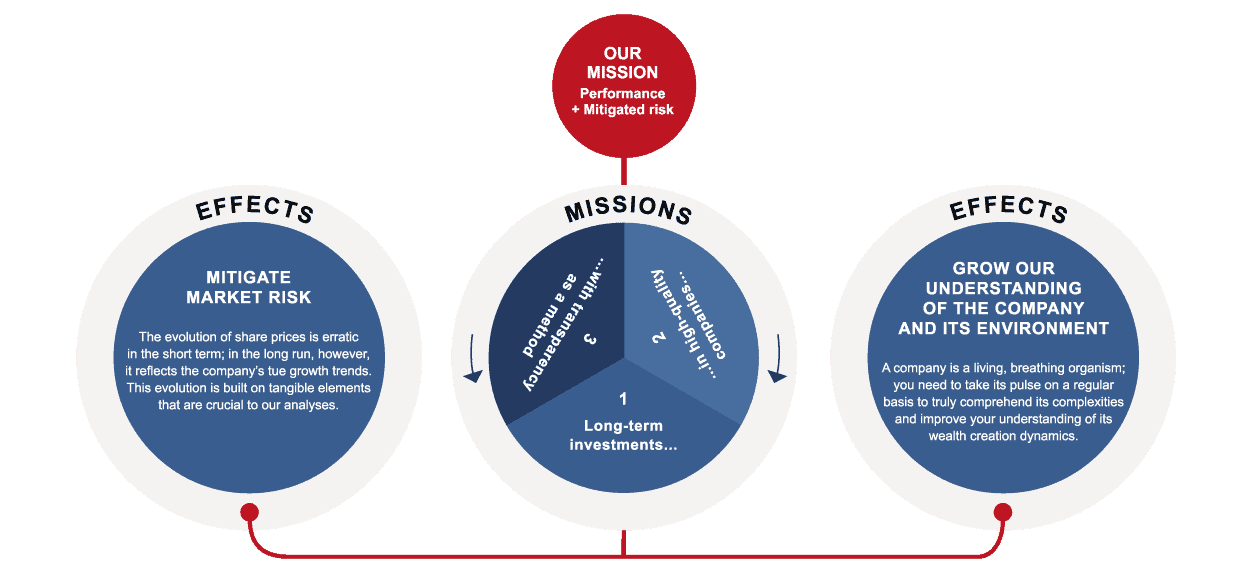

MISSION

Our practice

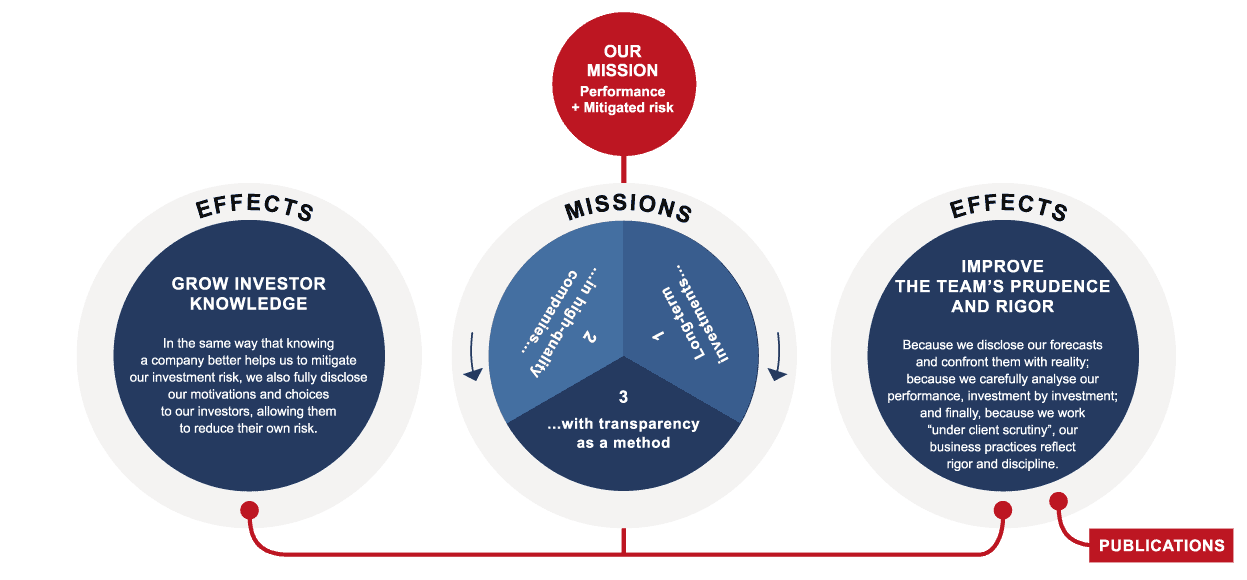

Long-term investment

In quality companies

With transparency as a method

OUR METHODOLOGY

We favour a meticulous qualitative analysis of companies, based on the idea that our understanding of them graduallygrows and becomes more precise: the longer we maintain a long-term investment in a company, the more our knowledge of it develops and becomes more refined. This incremental process of in-depth familiarization with companies lies at the heart of our strategy. Our fund, focused on the cloud sector, leads us to invest in the full range of companies in the field, from unprofitable companies in their initial growth phase, to rapidly expanding businesses, right through to mature, well-established players. This diversified approach enables us to capitalize on the momentum and growth potential inherent in the cloud sector, while at the same time fostering prudent, far-sighted management over the long term.